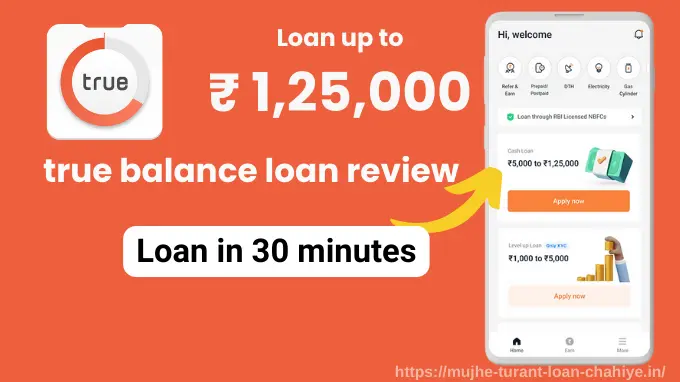

Do you want detailed information about the True Balance Loan app, fake or real, safe or not, True Balance loan review, loan limit, interest rate, eligibility criteria, loan tenure, approval time, etc?

True Balance Personal Loan App is a Gurugram-based financial platform operated by Balance Hero India Pvt Ltd and is trusted by more than 75 million users in the country.

Table of Contents –

True Balance Loan Review: Personal Loan Details

The True Balance app offers three types of personal loans: Welcome Loan, Level Up Loan, and Cash Loan.

| Loan Types – | Welcome Loan | Level Up Loan | Cash Loan |

|---|---|---|---|

| Loan Limit | ₹1,000 – ₹6,000 | ₹1,000 – ₹30,000 | ₹5,000 – ₹1,00,000 |

| Interest Rate | 3.9% P.M. | 2.4% P.M. | 2.4% P.M. |

| Tenure | 62 days | 3 months | 3-6-12 months |

| Processing Fees | 0 – 10% | 0 – 15% | 0 – 15% |

True Balance loan app is a Gurugram-based financial platform operated by Balancehero India Pvt Ltd offering three types of personal loans:

1. True Balance Welcome Loan

True Balance Welcome Loan is offered to new users or first-time users. The Welcome loan limit ranges from Rs 1,000 to a maximum of Rs 6,000, and the loan interest rate starts from 3.9% monthly. The repayment period is 62 days.

2. True Balance Level Up Loan,

The True Balance Level Up Loan is for returning users. With this category, returning users can apply for a level-up loan between Rs 1,000 to Rs 30,000. The Level Up Loan interest rate starts from 2.4% per month and has a maximum 3-month repayment period. Level Up Loans also improve the user’s credit score for future loans.

True Balance Level Up Loan Details:

- Instant digital personal loan with just KYC

- Loan credit amount: ₹1,000 – ₹30,000 (disbursement amount)

- Monthly interest rate: Starting from 2.4% per month

- Loan repayment period: 3 months

- Level-up loan processing fee: 0 – 15%

- Repaying the loan on time improves your credit score and gives access to higher funds

3. True Balance Cash Loan.

The True Balance Cash Loan is for existing borrowers. Existing borrowers who have taken the Welcome Loan and Level Up Loan and repaid them on time are eligible for True Balance Cash Loan.

Under Cash Loan, borrowers can apply for a personal loan ranging from Rs 1,000 to Rs 1 lakh. Cash Loan interest rates start from 2.4% per month and the repayment period is 3 to 12 months.

Website: click here

App link: click here

true balance loan eligibility criteria

Availing of a loan from True Balance requires the following simple criteria;

- You must be an Indian citizen.

- Your age should be between 18 to 45.

- Your minimum monthly income should be Rs 15,000.

- Your credit score must be 750 or higher.

- You must have a history of timely repayment.

- You must have a bank statement for a cash loan.

Documents Required for True Balance Personal Loan

True Balance requires minimal documentation with a 100% paperless process to apply for a personal loan, which includes;

- PAN Card

- Aadhaar Card

- Bank Account

- a selfie

- other documents as may be required.

true balance customer care number

For any queries or concerns related to True Balance Loan (Personal Loan), you can contact the True Balance team at the customer care number or email mentioned below;

- Contact: 0120)-4001028

- Email: [email protected]

cs@balancehero. com- customer care number

[email protected] is the True Balance customer care email address.

For any True Balance service-related queries or feedback, write to True Balance customer care email @ [email protected] and get a response within 24-48 working hours.

Is True Balance RBI registered or not?

Yes, the True Balance app is an RBI-registered lending platform. True Credits Private Limited, the lending partner of True Balance, is a subsidiary of BalanceHero India Private Limited, a non-banking financial company (NBFC-ND-NSI) regulated by the Reserve Bank of India (RBI).

True Credits Pvt. Ltd. also holds a Certificate of Registration from RBI to commence/carry on business as a Non-Banking Financial Institution (NBFC). The registered office of True Balance is located in Gurugram.

Is the True Balance loan app fake or real?

True Balance app is a 100% genuine app trusted by more than 75 million users across the country, and it ensures a 100% secure environment for its users.

True Balance app has partnered with several RBI-licensed NBFCs like True Credits Pvt Ltd, Incred Financial Services Ltd, Grow Money Capital Pvt Ltd, Muthoot Finance Ltd, Viverity Capital Ltd, and Northern Arc Capital Ltd and offers loans through them, that means True Balance is 100% safe and a genuine loan app.

FAQs – related to true balance review

the True Balance app is safe or not?

True Balance is a 100% secure platform and is approved by RBI. True Balance lending partner True Credits is an NBFC regulated by the Reserve Bank of India and follows regulatory standards.

What is the true balance loan limit?

The True Balance offers personal loans ranging from ₹1,000 to ₹1,25,000. The loan limit is determined by your income, credit score, and loan products, including Welcome Loan ₹1,000 – ₹6,000, Level Up Loan: ₹1,000–₹30,000, and Cash Loan: ₹5,000–₹1,25,000.

What is the true balance loan interest rate?

The interest rate for a True Balance personal loan is 2.4% per month.

What is the true balance loan eligibility CIBIL score?

The CIBIL score required to avail of a loan from True Balance is 750 or above.

What is the true balance loan approval time?

True Balance offers a quick and instant loan application process and disburses the loan amount within 30 minutes of approval.

true balance loan not paid what happens?

If you don’t pay a True Balance loan on time, you may be liable to pay a penalty fee of 1% per day for late payment.

What is the minimum loan amount in True Balance?

True Balance offers personal loans from as low as Rs 1,000 to as high as Rs 1,25,000 in just 30 minutes as per borrower requirements.

Conclusion – true balance loan review

In conclusion, the True Balance app is a reliable and secure personal loan app, RBI-approved, and trusted by over 75 million users across India.

Meeting the needs of all users, It offers a range of personal loans (Welcome Loan, Level Up Loan, and Cash Loan – as low as Rs 1,000 to as high as Rs 1,25,000).

All new or existing borrowers can avail of personal loans from True Balance with competitive interest rates, flexible tenure, and minimal documentation requirements.

Related articles –

Lone chiye

In a world where time is money, getting a loan should be quick and easy. With Creditmitra’s instant personal loan app, you can apply for loans without stepping out of your home. The app’s user-friendly interface allows you to apply for a personal loan online and receive fast approvals for urgent financial needs.