Do you need an instant personal loan to cover your unexpected expenses?

Poonawalla Fincorp loan might be the solution for you. Poonawalla Fincorp offers instant personal loans that promise to be fast and hassle-free.

But before going for a loan, it’s important to know about the loan details.

In this Poonawalla Fincorp instant loan review, we’ll cover everything about Poonawalla Fincorp personal loan, including the interest rates, eligibility criteria, and whether this service is genuine and RBI-approved, etc.

Let’s get started!

Table of Contents

Poonawalla Fincorp instant loan review – Personal loan

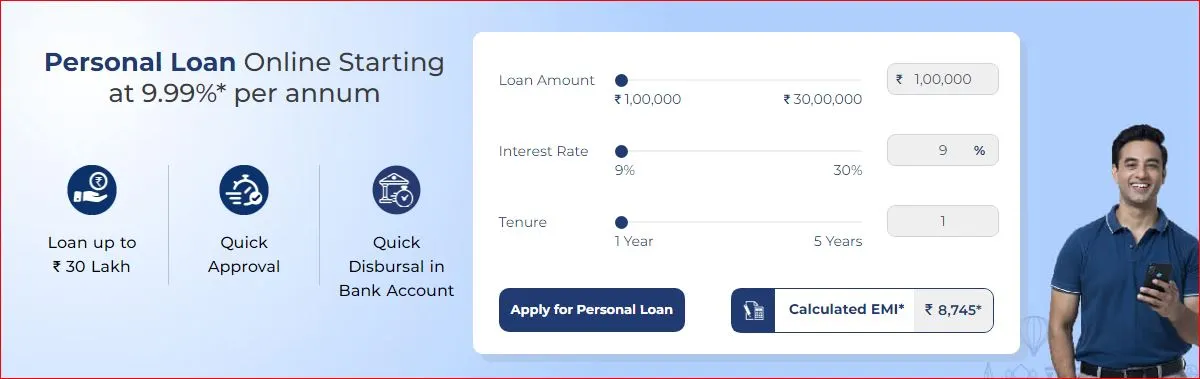

| Name | Poonawalla Fincorp Personal Loan |

|---|---|

| Loan amount | ₹1 Lakh to ₹30 Lakh |

| Loan interest rate | 9.99%* P.A. |

| Loan processing fees | 0% to 2%+GST |

| Loan Tenure | 12 – 60 months |

| Lowest EMI (P.M.) | ₹2,124* per Lakh |

| Foreclosure Charges | 0%* |

| Hidden charges | No |

Poonawalla Fincorp Private Limited is part of the Cyrus Poonawalla Group and headquartered in Pune, India. Poonawalla Fincorp is a financial services company registered with the Reserve Bank of India (RBI) as a Non-Banking Financial Company (NBFC).

Poonawalla Fincorp claims that an eligible borrower can avail of a personal loan ranging from ₹1 lakh to ₹30 lakh. The interest rate starts at 9.99% per year and 0% to 2% Processing Fees of the loan amount, plus GST. Offers a long-term repayment period between 12 to 60 months. The good news is that there are no foreclosures and hidden charges on Poonawalla Personal Loan.

Applying for a personal loan through the Poonawalla Fincorp instant loan app is safe. Poonawala Fincorp prioritizes customer data privacy and security and ensures that user information remains secure.

Poonawalla Fincorp Instant Loan Eligibility Criteria

Getting a personal loan from Poonawalla Fincorp is simple, and has minimum eligibility criteria:

- Applicant must be an Indian citizen.

- Applicant’s age should be between 22 to 57 years.

- Applicant must have a full-time job in specified organizations (Central Government, PSUs, MNCs, etc.).

- Applicant’s work experience should be at least 1 year, with at least 1 month of experience in the current job.

- Applicant’s monthly income should be at least ₹30,000 per month.

Documents Required Poonawalla Fincorp Personal Loan

- KYC documents – PAN Card/Aadhaar Card

- Income proof – last 3 months’ salary slips and bank statements.

- Address proof – Rent agreement, utility bills, or passport.

- Proof of Employment – Employee ID card or official mail ID.

Step-by-step guide: Poonawalla Fincorp Instant Loan Apply Online

Applying for a Poonawalla Fincorp Instant Loan instant online is simple and convenient. Follow these steps to apply for an Instant Loan:

- Visit the Poonawalla Fincorp Website & go to the Personal Loan Application page:

- Fill in your Basic Information in the form:

First Name

Last Name

Mobile Number

Email ID

PAN Number

Loan Amount

Loan Tenure - Next, provide personal details in the application:

Educational Qualification

Date of Birth

Gender

Address - Next, fill in your employment information:

Employer Name

Net Monthly Salary - Review the information you have filled in the application form:

Double-check all the details filled in the form to ensure their accuracy.

- Submit Your Poonawalla Fincorp instant loan Application:

Once you have reviewed and verified your information, submit your application form.

By following these simple steps you can apply for an instant personal loan online from Poonawalla Fincorp and get the desired loan amount for your needs.

Poonawalla Fincorp Login – Links

Poonawalla Fincorp Personal Loan – FAQs

Is Poonawalla Fincorp instant loan safe or not?

Yes, getting an instant personal loan from Poonawalla Fincorp is safe. It is a trustworthy Non-Banking Financial Company (NBFC) approved by RBI in India. Poonawalla Fincorp prioritizes customer data privacy and security, and the data remains secure.

Is Poonawalla Fincorp RBI approved?

Yes, Poonawalla Fincorp has been approved by the Reserve Bank of India (RBI) as a Non-Deposit Accepting Systemically Important Non-Banking Financial Company (NBFC).

Is Poonawalla Fincorp fake or real?

Poonawalla Fincorp Ltd is an RBI-approved Indian non-banking financial company (NBFC). RBI registration, part of the Cyrus Poonawala Group, transparency, customer data privacy, and positive reviews and ratings show that Poonawala Fincorp Limited is a genuine and legitimate financial services company.

What is the Poonawalla Fincorp personal loan interest rate?

Poonawalla Fincorp offers instant personal loans online at attractive interest rates starting from just 9.99% p.a. Loan processing fees range between 0% to 2% of the loan amount, plus taxes.

What are Poonawalla Fincorp personal loan foreclosure charges?

If you wish to repay your Poonawalla Fincorp personal loan early, there are no foreclosure charges (0%) if you use your own funds. However, if you borrow funds from other sources to repay the loan early, a charge of 4% is levied on the outstanding loan amount.

Conclusion –

In conclusion, Poonawalla Fincorp is a real platform for instant personal loans, ranging from ₹1 Lakh to ₹30 Lakh with competitive interest rates starting at 9.99% per year. There are no hidden charges and no foreclosure charges. If you meet the Poonawalla Fincorp loan eligibility criteria, it can be a trustworthy choice for your financial needs.

Related articles;