Are you thinking of taking a personal loan from the Finnable App? Here you will get the complete review of the Finnable App Personal Loan.

In this review, Finable Personal Loan features, loan limit, charges, processing fees, required documents, eligibility criteria, etc. are explained in detail so that you can decide whether to apply for a loan or not from the Finnable app.

Here is the Finnable app Personal Loan Review 2024;

Table of Contents –

Finnable Personal Loan Review 2024

The Finnable is an instant personal loan app that caters exclusively to salaried professionals in over 60 cities in India. With this app, an eligible borrower can avail of a personal loan ranging from ₹50,000 to ₹10,00,000 with a quick and easy approval process. To provide loans in a seamless and hassle-free manner, Finnable App has partnered with RBI-regulated NBFCs like “Finnable Credit Pvt Ltd” and “DMI Finance Pvt Ltd”.

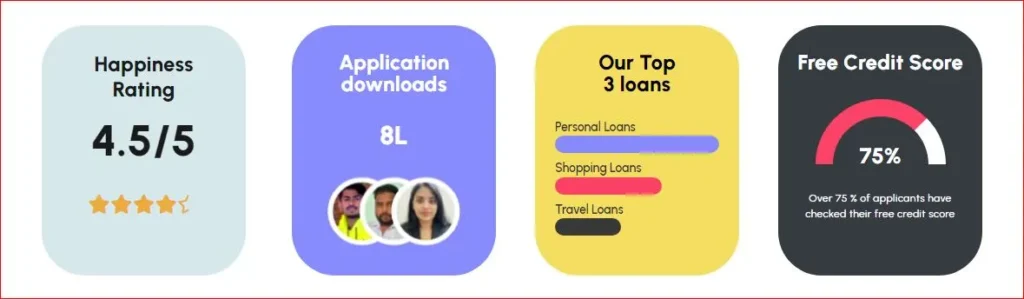

Here is the Finnable loan app analytics as of 2024;

Here are the key features of the Finnable personal loan;

- Provides loan approval in less than 30 minutes and deposits the amount directly into your bank account.

- Applicants with a minimum credit score can also qualify for a loan with the Finnable app.

- Applicants can apply for a loan without any paperwork through a 100% digital application process.

- Flexible repayment offers that suit your budget.

- There are no hidden charges on financial loans.

- No collateral is required for financeable loans.

- Finnable Personal Loan App is a responsible lender in India partnered with RBI-regulated NBFCs and financial institutions. This means that the Finnable app works as per the Indian regulations which ensures its safety.

Is Finnable loan safe?

Yes, the Finnable instant personal loan app is a safe and responsible Lending platform, because the Finnable app has partnered with RBI-regulated NBFCs/Financial Institutions, and its policies and services are fully regulated and legally compliant. Two Lending partners of the Finnable app are “Finnable Credit Private Limited” and “DMI Finance Pvt Ltd”.

Finnable app ensures customer safety through standard security and does not share any user’s personal information with third-party apps.

Is Finnable RBI approved?

Yes, the Finnable is a Non-Banking Financial Company (NBFC) registered and approved by the Reserve Bank of India (RBI). Also, Finnable has partnered with NBFCs/Financial Institutions authorized and regulated by RBI, and its policies and services are fully regulated and legally compliant.

Lending partner of the Finnable app:

- Finnable Credit Pvt Ltd

- DMI Finance Pvt Ltd

- Northern Arc Capital Ltd

- Vivriti Capital Pvt Ltd

- Utkarsh Small Finance Bank Ltd

- TVS Credit Services Ltd

- HDB Financial Services Ltd

- Piramal Capital and Housing Finance Ltd

Is Finable India real or fake?

Yes, the Finnable India Loan App is real as Finnable Credit Private Limited is an NBFC (Non-Banking Financial Company) registered and regulated by RBI (Reserve Bank of India) which makes Finnable Finance one of the fastest-growing financial technology (Fintech). The Finnable provides hassle-free loans with a quick and easy loan application process. Approves the loan within a few hours of verification, with the help of digital documentation. With flexible and attractive personal loan interest rates, applicants can choose the tenure and EMI options that best suit their needs.

For manual verification, you can check the following details of the Finnable App, on the Google Play store;

Rating: 3.9

Downloads: 10L+

Finnable is real or fake?

What is the Finnable personal loan interest rate?

Finnable offers instant personal loans with flexible interest rates. Finable App charges interest rates on personal loans between 1.3% and 2.3% per month on the reducing balance method, depending on the CIBIL score and monthly income of the applicant. Also, Finnable charges a very nominal processing fee of 4% on the approved loan amount.

✅ Example: if you apply for a Finnable Personal Loan;

- Personal Loan – ₹1,00,000

- Interest rate – 16%*(on a reducing balance basis)

- Repayment Tenure – 12 months

- processing fee of 3% + GST

- Final processing fee – ₹3,000 + ₹540

- Total personal loan amount – ₹1,03,540

- Amount disbursed – ₹1,00,000

- Monthly EMI = ₹9,394

- Total interest = ₹9,191

- APR – 21.97%

- Total Repayment amount – ₹1,12,731

What are the Finnable loan eligibility criteria?

To be eligible for a Finnable Personal Loan you must meet the following criteria;

- A salaried professional.

- Monthly Income of Rs. 25,000 or more in metros, or Rs. 15,000 or more in Tier 2 and other cities.

- 6 months of work experience.

- 650+ Credit score for first-time borrowers.

- Valid documents like Aadhaar, PAN, and address proof.

Finnable Loan Customer Care Number

Email: [email protected]

Conclusion –

Hopefully, through this blog, you have got a detailed review of the Finnable Instant Personal Loan App whether the Finable App is safe or not, approved by RBI or not, real or fake. What do you think about the Finnable instant personal loan, share your thoughts in the comment box below. thanks!

Source: Internet

Related articles;