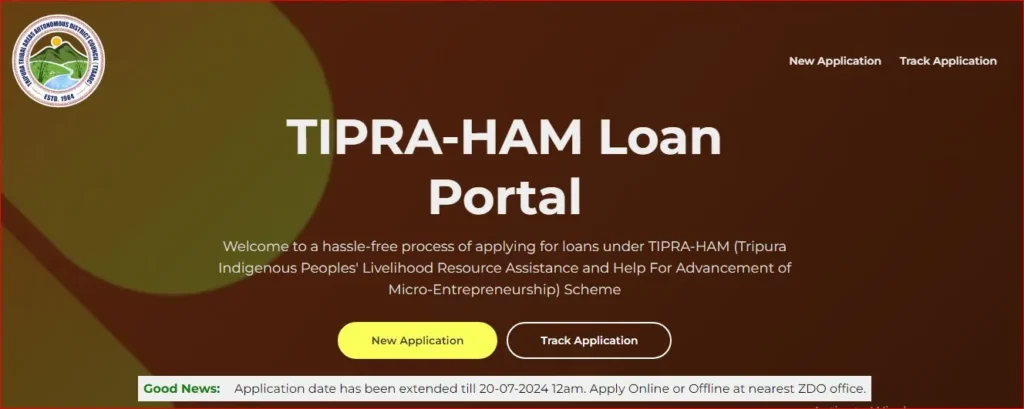

Tipra Ham Loan Portal – tipraham.in (Auto loan apply online)

Using this online Tipra Ham Loan Portal – tipraham.in you can apply or register for a tipra ham loan online…

Table of Contents

What is the Tipra Ham loan scheme – auto loan

The TIPRA-HAM loan (Tripura Indigenous Peoples Livelihood Resource Assistance and Help in Advancing Micro Entrepreneurship) scheme is a financial initiative launched by the government to support Tripura’s Indigenous communities in India.

The objective of the Tipra Ham Loan Scheme is to provide loans and financial assistance in various sectors to the indigenous communities of Tripura to help them develop sustainable livelihoods and pursue micro-entrepreneurial ventures.

TIPRA-HAM Loan Full Form: Tripura Indigenous Peoples Livelihood Resource Assistance and Help in Advancing Micro Entrepreneurship.

Tipra Ham Loan Portal – auto loan apply online

Tipra Ham loan portal is an online platform launched by the Government of Tripura where all interested applicants can apply for auto loans directly. Through this online auto loan portal (which can be accessed at tipraham.in) all the applicants can easily apply or register for Tipra Ham auto loan online from their mobile.

Quick links;

Tipra Ham auto loan details: Subsidy, Interest

| Scheme Name | Tipra Ham Auto Loan |

|---|---|

| Loan amount | Total cost of Vehicle |

| Interest rate | 6% per annum |

| Loan tenure | 24 months to 60 months |

| Subsidy benefits | 20% of the loan |

| Application fee | Rs 500 non-refundable |

| Collateral required | Vehicle itself |

Tipra Ham Auto Loan Yojana is a financial scheme launched by the Government of Tripura. This scheme provides financing facilities to individuals who want to purchase vehicles. Tipra Ham portal offers auto loans to cover the total cost of the purchasing vehicle.

The interest rate of a Tripura ham loan is 6% per annum and the repayment period ranges from 24 to 60 months.

Additionally, the scheme comes with a 20% subsidy on the loan amount.

Tipra Ham loan application is 100% online, and a non-refundable fee of Rs 500 is required to complete the registration. No additional collateral is required.

How to apply Tipra Ham auto loan online – registration

You can apply for a “Tipra Ham Auto Loan” online. It involves filling out a detailed application form and uploading various supporting documents. Here is a step-by-step guide to help you with the auto loan application process:

- Visit the Tipra Ham Auto Loan Application Portal – tipraham.in

- Click on the “new application” button to begin registration.

- Fill in your Personal Information in the Tipra Ham application form.

Full Name

Aadhar Number

ROR/Ration Card Number

PAN Number

Mobile phone number.

Gender: Male/Female - Choose your current employment details & address details.

Government employee

Private employee

Unemployed - Fill in your Permanent & Communication Addresses.

Zone

Sub Zone

Name of VC

Village

Police Station

Post Office

Postal Pincode - Fill In Your Additional Personal Information: Social Category.

ST

- Choose your education Qualification: Highest qualification.

8th pass, 10th pass, 12th pass, graduate, master degree or above

- Fill in your Identification and Financial Details.

Date of Birth

Your Driving Licence No

Driving Licence Validity date

Present your Annual Income - Provide your Utility and Bank account Details

Bank account number,

Beneficiary name,

Branch name,

IFSC code - Upload the required documents for a complete application.

Aadhar Card,

PAN Card,

ROR/Ration Card,

Age Proof,

Bank Passbook,

Caste Certificate,

Educational Qualification Certificate,

Driving Licence,

and Current image.File size should be less than 2 MB.

- Finally, proceed to pay the loan application fee of Rs 500 and complete your application.

By following the above steps, you can complete your Tipra Ham auto loan application online.

Quick Links for Users:

Tipra Ham auto loan eligibility criteria

Here are the eligibility requirements for a Tipra Ham auto loan, you must meet the following criteria:

- You must be a permanent resident of the TTAADC area.

- You must be between 21 to 45 years of age.

- The minimum educational qualification 8th pass.

- You must possess a valid driving license.

- Your house must have an electricity connection.

- Only one person per family is eligible to apply for the loan.

- You must have the capability to contribute 15% of the total cost of the auto as margin money.

- You must have a minimum CIBIL score of 680.

- You must provide a copy of the ROR (Record of Rights) or ration card.

Beneficiary selection for Tipra Ham Loan

Here is a Beneficiary selection process for Tipra Ham Auto Loan:

- Your applications will be reviewed by a scrutiny committee.

- Personal hearing may be conducted if required.

- After scrutiny of the applications, final approval will be obtained from the TTAADC authority.

- Your approved applications will then be sent to the bank for loan approval.

Conclusion –

In conclusion, Tipra-Ham Auto Loan is a self-employment generation scheme launched by TTAADC, With an online application process, simple eligibility criteria, and favorable terms, the scheme ensures that a large number of unemployed youth are developed as potential individuals and generate self-employment.

This is the Tipra Ham loan portal for Tipra Ham auto loan apply online. thanks.

Related posts: